Op-Ed: America's Entrepreneurial Spirit is Dying

Options

Young_Chitlin

Members Posts: 23,852 ✭✭✭✭✭

By: Kevin Montgomery

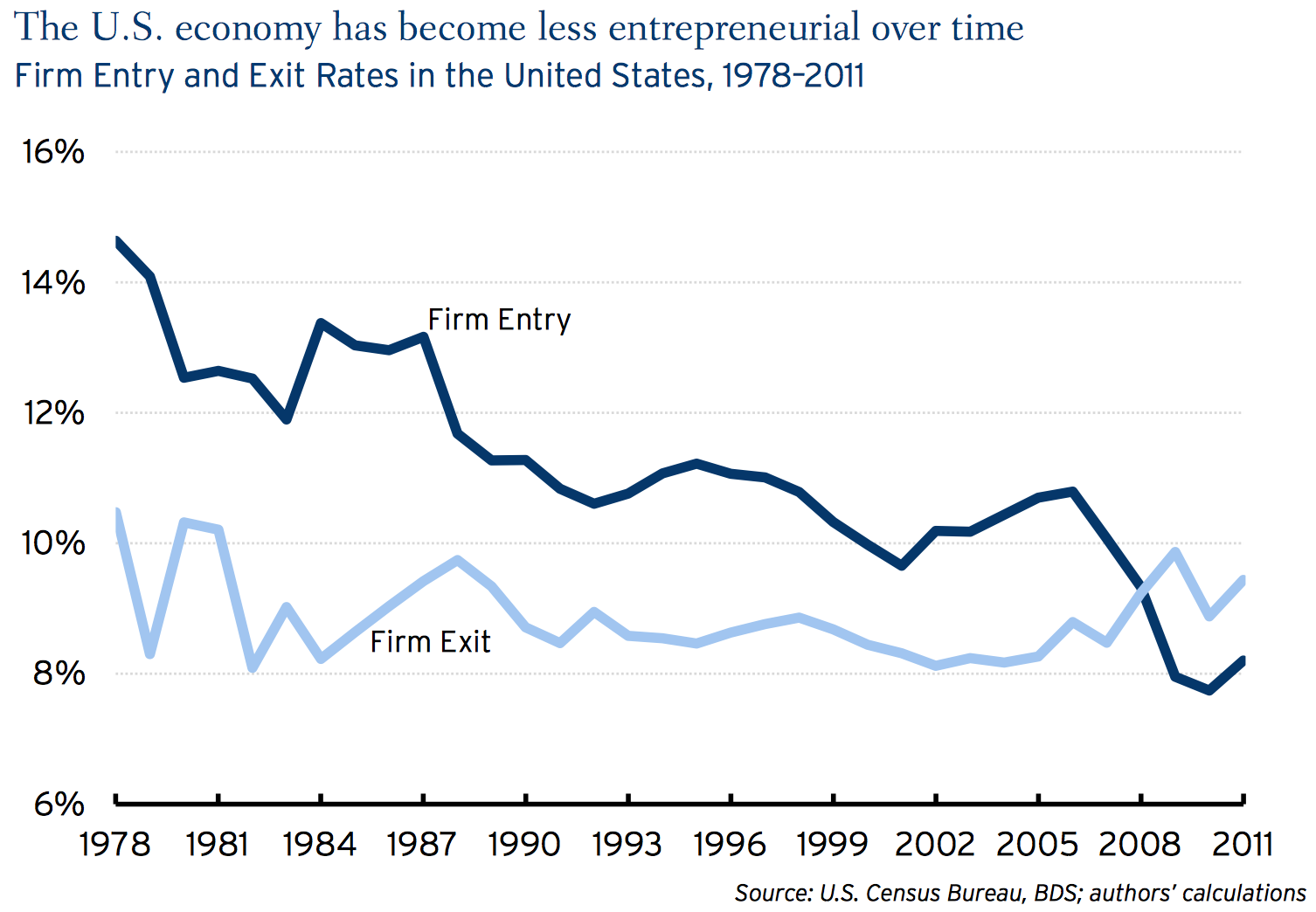

With all the tech startups flooding the market, it would seem that America is more entrepreneurial than ever. But just the opposite is true. According to a pair of reports from The Brookings Institution, American entrepreneurship has been declining since the 1970s.

Brookings' reports reveal that American business has become steadily less dynamic in the past three decades. Instead of creating new companies, would-be entrepreneurs are increasing going to work for established corporations. And the rate of corporate consolidation is only making the statistic worse.

Now, for the first time since Brookings began tracking the data, more businesses are dying than being born in America.

As New York's Daily Intelligencer describes, all the media fanfare over startups is only masking the truth behind the state of entrepreneurship:

But the glitz, glamour, and big money of San Francisco — as well as the cultural potency of and media attention paid to start-ups — shroud a hard truth. The country is getting less entrepreneurial. In aggregate, firms are aging. People are starting fewer new businesses, and older businesses are doing better than their younger competitors. For all the talk of "disruption" in today's economy, it is better to be a big, old incumbent dinosaur than it is to be a lean, mean start-up.

This isn't just bad for potential founders, Brookings says. The trend curbing "creative destruction" has the potential to make the entire American workforce less productive:

Research has established that this process of "creative destruction" is essential to productivity gains by which more drive out less productive ones, new incumbents, and workers are better matched with firms. In other words, a dynamic economy constantly forces labor and capital to be put to better uses.

The problem isn't relegated to "The Paper Belt"—Silicon Valley's dismissive name for Middle America. Brookings reports that the entrepreneurial downturn transcends any particular state and region. The trend has been observed in all 50 states and "in all but a handful" of the 360 metropolitan areas tracked.

What's more? "This decline has been documented across a broad range of sectors in the U.S. economy, even in high-tech."

Brookings' reports are not all doom and gloom, however. The public policy organization notes that "business accelerators" are a "welcome development." And immigrants, being statistically twice as likely than native-born Americans to start businesses, could be allowed in the country in greater numbers to help reverse the trend.

http://nymag.com/daily/intelligencer/2014/08/america-is-getting-less-entrepreneurial.html

http://www.brookings.edu/~/media/research/files/papers/2014/05/declining business dynamism litan/declining_business_dynamism_hathaway_litan.pdf

Comments

-

-

I went to a Tech Startup Mixer back in June in Philadelphia and I got there very early and talked to a younger gentleman who was in a secluded room to discuss a startup. They were running ideas and trying to work everything out to get the attention of the venture capitalists. Many young companies that I've seen have sold their ideas or presented their ideas to venture capitalists in hopes of creating opportunities. In the same building, same floor a year before I interviewed with a startup who wanted me to come from A.C. to Philly to work for them as an intern for their company. They were building their company to gain attention of the venture capitalists...thats the problem.

Some startup companies try to create an idea to sell to a venture capitalist in hopes that they can either cashout and sell to that VC or use it to build their companies. In my honest opinion based on what I've seen in the past few years, the bootstrapping method of creating businesses has gone out the door because of the availability of the VC and not taking the time and energy to build your business from the ground up. FOUNDATION!!! To build something, you have to have a strong foundation. Whether you put your own money or borrow from a small loan, you are preparing your company for any events that may happen. NO company, idea, or person is perfect but thirst for instant fame or wealth damages the ideology of the company. Some are successful, don't get me wrong but for the most part owners do not think about longevity.

Another thing, older companies that are successful find something that works and focus on making that better and it leads to specializing in that particular service or product. Thats because they are constantly monitoring their performance and if there is nothing that is working, sit at the table and reinvent how to sell your product, service, or idea. Dame Dash said to become an entrepreneur you have to believe in yourself 100% with no security. Starting from nothing and finding out a way to make your first deal then how to multiply that is the best way to promote longevity in business today. -

Check out this book, Traction

Description caught my attention:Almost every failed startup has a product. What failed startups don't have is traction -- real customer growth.

http://tractionbook.com/ -

The problem is with these mega corporations running smaller companies out of business. A lot of those would be entrepreneurs may never be able to compete. The tech market is probably the best place for entrepreneurs with new ideas.

-

housemouse wrote: »The problem is with these mega corporations running smaller companies out of business. A lot of those would be entrepreneurs may never be able to compete. The tech market is probably the best place for entrepreneurs with new ideas.

We are having the same conversation. A good majority of these new startups and companies ARE in some space or form part of the Tech Market. And you are absolutely on the money about mega corporations either running smaller companies out of business OR buying them out. Here's the kicker, the Venture Capitalist are the ones doing the supplying! That's where the multi-million dollar deals are being made everyday with startups being displayed as portfolio items. It's just like Real Estate, only the start-up/small company edition. -

It's all about Capital.. Big Fish almost always eat little fish.. If you are little fish you either have to grow fast and become big or risk being eaten by a bigger fish it seems..

Also it seems the only way to go from little fish to big fish is to come to market with some kind of disruptive technology.. A la Uber.. -

EmM HoLLa. wrote: »It's all about Capital.. Big Fish almost always eat little fish.. If you are little fish you either have to grow fast and become big or risk being eaten by a bigger fish it seems..

Also it seems the only way to go from little fish to big fish is to come to market with some kind of disruptive technology.. A la Uber..

Um, more like have an idea and protect it with your life. Because when you create something Uber-ish of value and it becomes an overnight sensation, VC's, rivals, and aspiring startups are watching. -

Hey guys, I wanted to share this article from Sam Hogg at Entrepreneur:

http://www.entrepreneur.com/article/241507I teach a business class at a university here in Michigan, and it pains me to discuss ABC’s Shark Tank with my students. They love the show, in which entrepreneurs pitch their businesses to billionaire Mark Cuban and other venture capitalists in a bizarro setting where deals involving hundreds of thousands of dollars are mixed with a VC version of speed dating. My students believe that getting on Shark Tank and making a deal is a punched ticket to entrepreneurial stardom.

I can’t decide whether Shark Tank is a wonderful motivator or the worst thing that ever happened to my industry. Here’s why: The focus is on money, not on value. My biggest pet peeve with the show is seeing entrepreneurs more fascinated with pitching and raising venture capital than with building value—as if the default way to start a company nowadays is by having someone pay you to do it.

Entrepreneurship is about creating valuable things by summoning every possible resource you can, only some of which is other people’s money. Starting this long journey by selling off a third of your equity or more on a TV show should not be the model.

I also have issues with how little time is spent on the actual mechanics of the deals. With so much focus on getting a deal done, founders on the show have very little time to get a good one. I have even seen the sharks send the founder out of the room so they can syndicate and collude. This is the opposite of what an entrepreneur should strive for: a transparent auction process to get the best deal.

Perhaps I’m just feeling the way lawyers feel when they watch an episode of Law & Order, but Shark Tank minimizes the difficulty of building a valuable company and the complexity of executing an actual equity deal. But that’s what TV has to do: shrink a transaction that can take weeks to hammer out down to 10 minutes.

I will give the show some props, though. Despite its flaws, it teases out the very best of entrepreneurial drama and makes an industry populated mostly by nerds (like me) seem sexy and fun. And in a reality-TV world dominated by celebrity wives and ? shops, it is great to see innovators get some well-deserved airtime.

This is right on the button to what I was saying before! -

I tell ya, when it rains it pours.

Check this out:

http://www.worldstarhiphop.com/videos/video.php?v=wshhC3L5eB5eNiB298zM

Here's a follow up article:

http://financialjuneteenth.com/this-student-has-created-the-hottest-scholarship-app-in-america-and-investors-are-raving/The high cost of college attendance has given many people reason for pause when it comes to choosing how their kids should construct their futures. Universities have pushed tuition prices out of reach, so getting a scholarship has become entirely essential for those seeking to foot the massive bill that comes with trying to get an education.

If you haven’t heard of the “Scholly” app, you probably should know about it. The app allows students to search for scholarships that they qualify for within minutes and apply online. The app costs just 99 cents and has been downloaded hundreds of thousands of times.

The strange thing about this news report (below) is that they show a picture of the creator of the app, but don’t actually mention his name. We’re not sure what that’s all about.

The student who created the app is named Christopher Gray and he’s a student at Drexel University. He’s equipped for the next generation by being a major in both business and entrepreneurship. He’s also making an appearance on the hit show, “Shark Tank,” which is highly anticipated. Apparently, the buzz has to do with the fact that one of the investors makes an offer to own a piece of Gray’s company without asking any questions. This causes two of the others to walk off the set in a fit of anger.

Gray himself did well as a high school student, applying for 34 scholarships and winning a combined total of $1.3 million. That’s not a bad haul in a world where the cost of college has now made it out of reach for millions of American families.

“So with Scholly, we would build up this algorithm that instantly aggregates and then match students with scholarships they qualify for,” said Gray.

You can download this extraordinary app on both iTunes and Google Play.

Here’s the news story we told you about. We’re still dying to know why they didn’t mention this brother’s name in the report. -

Dope, I've been dropping all I can!

-

YOOO, I'm at Pipeline Philly today working on my business. Remember that link I shared with Chris Gray and his appearance on Shark Tank? I just saw him working in the office, I'll see if I can talk with him.